From the Field to the Futures: Grain Market Update

Aug 01, 2025

By Nathan Flores and Ella Roberts, GCC Grain Team

Corn and soybeans both saw losses for the month of July, while wheat had intra-month volatility but ended the month at a similar price that it started.

Corn conditions continue to impress, with 73% rated as good to excellent, 5 points higher than last year. Only 7% is rated poor to very poor, down 2 points from last year. In Kansas, 66% of the corn is good to excellent, and 9% is poor to very poor. Currently, 77% of corn in Kansas is in the silking stage, and 36% has reached the dough stage, matching national averages.

Soybean conditions have improved as well, rising by 2 points to 70% good to excellent. Poor to very poor beans now make up only 6%. In Kansas, 68% of soybeans are rated good to excellent, while 6% are poor to very poor. In Kansas, 63% of soybeans are blooming, and 27% are setting pods.

Milo conditions stand at 66% good to excellent, with 8% rated poor to very poor. Kansas milo is slightly lower at 63% good to excellent, with 19% heading and just 3% coloring.

Winter wheat harvest is winding down, with 80% of the U.S. crop harvested. Kansas is all but finished at 99%, along with most Midwestern states. The national average is still 1 point behind last year and the five-year average.

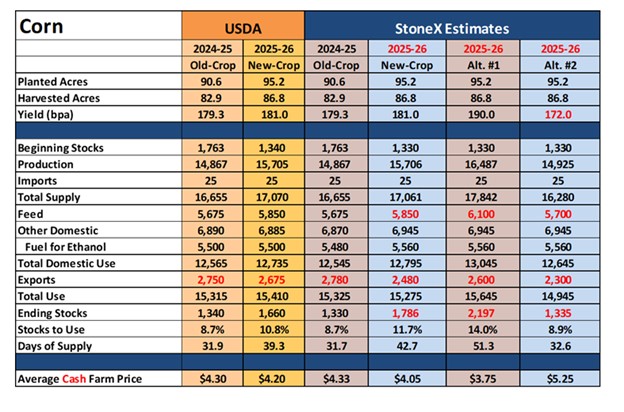

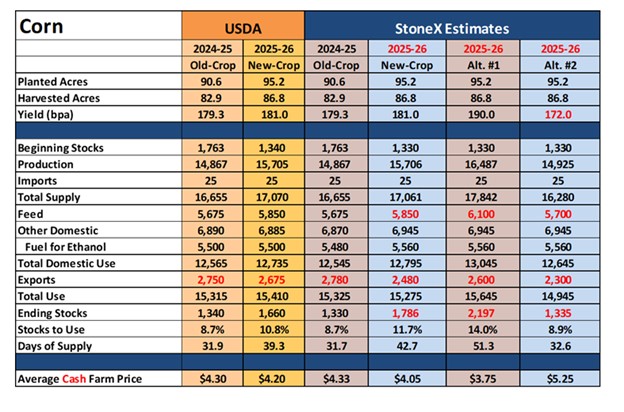

As far as markets go, December corn futures keep hovering above the critical support level of $4.10/bushel as the market digests potential crop sizes and carryout. With the corn crop looking so good across the Corn Belt, some in the trade are adjusting their yield models to predict a national yield of 190 bushels per acre, a 5% increase over the trend. USDA’s current yield estimate sits at 181 bushels per acre.

The balance sheet below shows two scenarios on the far right: one with a 190 yield, while the other estimates a 5% reduction to 172 bushels per acre. Higher yields would be the result of an ideal weather pattern through August, while a lower yield might be the result of potential pollination issues that have been reported in some growing areas. While most are assuming higher yields, it’s important to understand the market implications of both scenarios. Today’s market feels weighed down by the potential size of the U.S. corn crop that is supported by good crop conditions.

Even though current prices might not feel particularly exciting, it is worth thinking about what levels could make sense for your operation. Reach out to a member of the GCC Grain Team and let us help you navigate through these markets!

Corn and soybeans both saw losses for the month of July, while wheat had intra-month volatility but ended the month at a similar price that it started.

Corn conditions continue to impress, with 73% rated as good to excellent, 5 points higher than last year. Only 7% is rated poor to very poor, down 2 points from last year. In Kansas, 66% of the corn is good to excellent, and 9% is poor to very poor. Currently, 77% of corn in Kansas is in the silking stage, and 36% has reached the dough stage, matching national averages.

Soybean conditions have improved as well, rising by 2 points to 70% good to excellent. Poor to very poor beans now make up only 6%. In Kansas, 68% of soybeans are rated good to excellent, while 6% are poor to very poor. In Kansas, 63% of soybeans are blooming, and 27% are setting pods.

Milo conditions stand at 66% good to excellent, with 8% rated poor to very poor. Kansas milo is slightly lower at 63% good to excellent, with 19% heading and just 3% coloring.

Winter wheat harvest is winding down, with 80% of the U.S. crop harvested. Kansas is all but finished at 99%, along with most Midwestern states. The national average is still 1 point behind last year and the five-year average.

As far as markets go, December corn futures keep hovering above the critical support level of $4.10/bushel as the market digests potential crop sizes and carryout. With the corn crop looking so good across the Corn Belt, some in the trade are adjusting their yield models to predict a national yield of 190 bushels per acre, a 5% increase over the trend. USDA’s current yield estimate sits at 181 bushels per acre.

The balance sheet below shows two scenarios on the far right: one with a 190 yield, while the other estimates a 5% reduction to 172 bushels per acre. Higher yields would be the result of an ideal weather pattern through August, while a lower yield might be the result of potential pollination issues that have been reported in some growing areas. While most are assuming higher yields, it’s important to understand the market implications of both scenarios. Today’s market feels weighed down by the potential size of the U.S. corn crop that is supported by good crop conditions.

Even though current prices might not feel particularly exciting, it is worth thinking about what levels could make sense for your operation. Reach out to a member of the GCC Grain Team and let us help you navigate through these markets!